|

Getting your Trinity Audio player ready...

|

Government securities like Treasury bill (T-bill), government bond and State Development Loans (SDL) offer the highest amount of capital safety, as they come with a sovereign guarantee. Moreover, long term (more than 20 years) government bonds will always give better returns than bank FDs. If you don’t know what a T-bill or a bond is, please read our article on the same by clicking here.

But many individual/retail investors think that only banks and big institutional investors are allowed to invest in such securities. That’s not true. Individual/retail investors can also invest in these type of securities for amount as minimum as Rs.10000. Moreover, it’s effortless to invest in. There are two ways to invest:

1. Buying G-Sec through NSE goBID platform:

National Stock Exchange (NSE) recently launched a new platform called Gobind for retail investors, to enable them to invest in government securities. To use this platform, an investor must be a resident individual of India and should possess a PAN card along with a DEMAT account.

Sign-up Process:

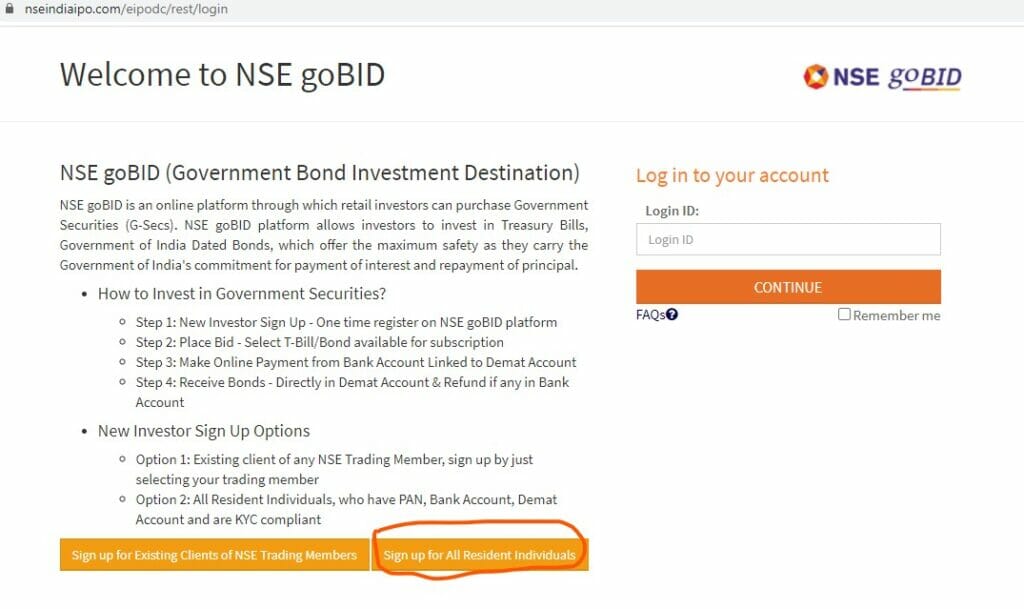

- Investor should visit goBID platform website. A webpage like below will get open.

- Then, click on ‘Sign up for All Resident Individuals’ button (circled in red in above image).

- Fill out the basic details like Name, PAN card number and DEMAT account details.

- Set out a strong password with at least one uppercase & lowercase letter, digit and a special character.

- After submitting correct details, E-KYC process will start, under which you will get different OTP on your mail id and mobile number associated with your PAN card.

- Once you enter both OTPs, it’s done. Account is successfully created.

- Now for login, your login id will be your PAN card number and the password is what you had set.

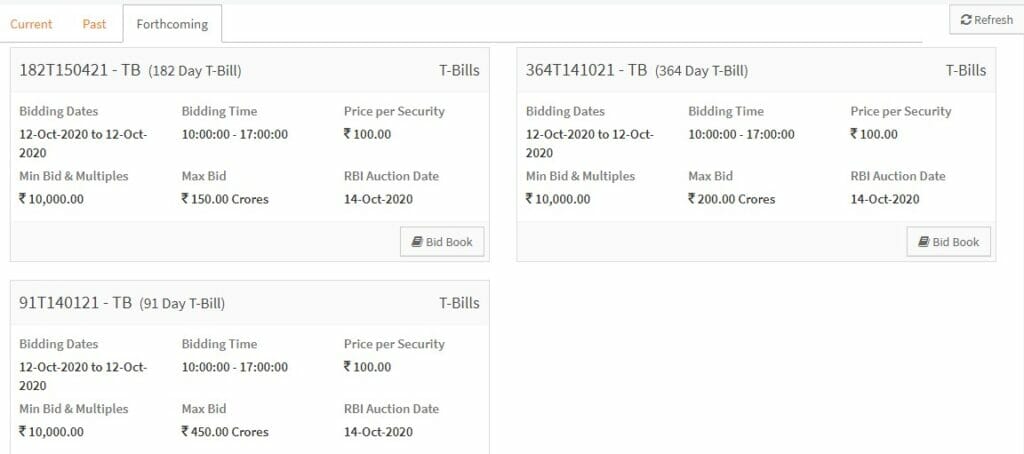

Once you login, you can see three tabs, viz. Current, Past & Forthcoming as below:

Now, you can invest in T-bills, government bonds and SDLs for a minimum amount of Rs.10000 and thereafter multiples of Rs.10000. It’s much like an IPO, when any G-sec open for subscription, individual investors can apply for it under non-competitive bidding (NCB) option without mentioning bid price/yield. NSE acts a facilitator in NCB for retail investors by aggregating the applications received from retail investors and submits a single bid to RBI. On the other hand, banks and other institutional investors can bid for the price of T-bill or interest/yield of bond and SDLs.

Please note, through goBID platform, you can invest for fresh G-Sec only which are hitting the primary market. You cannot buy G-Secs which are being traded in secondary markets using this platform.

2. Buying G-Sec Through Registered Broker:

Brokers like zerodha have given the dual facility to either apply for new issues of G-sec or buy them from secondary market. But brokerage firms charge 0.06% or Rs.6 for every Rs.10000 invested through their platform as a brokerage fee.

NSE goBID platform do not charge any fee as of now.

Disclaimer: This information is only for educational purposes. Please consult your own financial advisor before investing.

–@|<

I believe your opinions are quite fascinating, I appreciate reading what you write. Hope to hear more from you. Subscribed.

My partner and I stumbled over here

from a different web page and thought I

may as well check things out.

I like what I see so now I’m following you. Look forward to going over your web page for a second time.

Thanks for finally writing about > Government Securities (G-Sec),

How to buy? – We are the best trading & investment < Loved it!

I do believe all the ideas you’ve offered in your post.

They are very convincing and will definitely work.

Nonetheless, the posts are too brief for novices.

Could you please extend them a bit from subsequent time?

Thank you for the post. asmr 0mniartist

Link exchange is nothing else but it is just placing the other

person’s website link on your page at proper place and other person will also

do same in support of you. 0mniartist asmr