|

Getting your Trinity Audio player ready...

|

About the Company:

Gland Pharma, established in 1978 at Hyderabad, operates primarily in B2B segment of Pharma sector. Company sells its products in over 60 countries including USA, Europe, Canada, Australia, India and the rest of the world. It has 7 manufacturing plants in India with annual production capacity of approx. 750 million units. These include four facilities with 22 production lines for finished formulations and three Active Pharmaceutical Ingredient (API) facilities.

Company operates in sterile injectables, oncology and ophthalmic segments, and focus on complex injectables including NCE-1s, First-to-File products and 505(b)(2) filings. Company’s primary business model is B2B, covering IP-led, technology transfer and contract manufacturing models, complemented by a B2C model in home market of India.

Gland Pharma Financials:

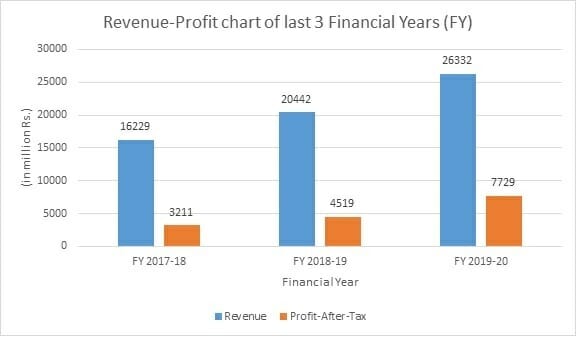

Company’s revenue from operations is getting increased by more than 25% in last three financial years. In FY 2020, company’s 95.99% revenue came from its B2B segment, while remaining 4.01% came from its B2C operations in India. Its other income increased by 62.65% to Rs.1391.68 million in Fiscal 2020 from Rs.855.64 million in Fiscal 2019. This was primarily due to an increase in net foreign exchange gain as a result of Rupee depreciation against the US dollar in Fiscal 2019, and to a lesser extent was also due to an increase in profit on the sale of unused freehold land and buildings.

Company’s total expenses increased by 25.02% to Rs.17795.42 million in Fiscal 2020 from Rs.14234.10 million in Fiscal 2019. Also, its Profit-After-Tax(PAT) increased by around 71% to Rs.7728.58 million in FY20 as compared to Rs.4519.07 million of FY19.

Earnings per Share (EPS) stood at Rs.49.88 as of FY20, as compared with Rs.29.16 of FY19. For the quarter ended in June 2020, company generated revenue of Rs.9162.89 million and made profit-after-tax (PAT) of Rs.3135.9 million.

Promotors’ Shareholding Pattern:

Fosun Pharma Industrial Pte. Ltd and Shanghai Fosun Pharmaceutical (Group) Co. Ltd is the company’s promoters, holding 74% of total company shares.

| Promotors | No. of shares held | % of Total shares of the company |

| Fosun Pharma Industrial Pte. Ltd | 114,662,620 | 74% |

| Gland Celsus Bio-Chemicals Private % of total Limited | 20,094,870 | 12.97% |

| Empower Discretionary Trust | 7,865,000 | 5.08% |

| Nilay Discretionary Trust | 3,749,000 | 2.42% |

| Total | 1463,71,490 | 94.47% |

Gland Pharma IPO Offer:

| IPO open for subscription | 9th November-11th November, 2020 |

| Number of fresh issue of shares | 34,863,635 |

| IPO Size | Rs.1250 crore |

| Face Value | Re.1 per equity share |

| Price Band | Rs.1490-Rs.1500 per equity share |

| P/E Ratio | 18.52 (as per EPS of June, 2020) |

| Minimum Order Quantity | 10 Shares |

| Minimum Investment at higher price band | Rs.15000 |

| Finalisation of allotment of shares | 17th November, 2020 |

| Probable listing date on NSE & BSE | 20th November, 2020 |

| Link for checking the allotment status | https://linkintime.co.in/MIPO/IPO.aspx |

Verdict:

Company’s financials look great! Current boom in Pharma sector is another positive factor of this offer. Offer is fairly priced at 18.52x according to its EPS of June quarter. Gland Pharma is aiming to raise in total Rs.6479.54 crore at higher price band, out of which, it already raised Rs.1943.86 crore from 70 anchor investors.

Current global negative sentiment about the China may affect company’s sales, as promotors of the company are mainly based out of China. Thus, risk-savvy investors can subscribe for Gland Pharma IPO on 1st day, while risk-averse investors can wait till last date i.e. 11th Nov and take a call according to subscription numbers.

You can check our daily analysis of stock markets by clicking here.

–@|<